Natural gas and electricity prices change frequently and can have a significant impact on your costs to operate your business. In fact, if you are located in a deregulated state and have the option to source your energy supply on the open market, understanding the factors that affect energy prices is critical to securing a low rate. In this article, we will discuss the major fundamentals that have a direct impact on the price of electricity and natural gas so you can better understand the best times to sign your next energy supply agreement.

Electricity and Natural Gas Correlation

First and foremost, it is important to understand the price correlation between electricity and natural gas. Since natural gas is the leading source of electricity generation in the U.S., accounting for just over 40% of total production, these markets are closely correlated. In fact, over the past fifteen years, on a scale of 0 to 10 where 0 is “least correlated” and 10 is “most correlated”, natural gas and electricity correlation ranges from 8.1 to 9.6 depending on location. Due to this fact, we will study the fundamental market drivers of natural gas closely in order to gain a comprehensive view of both markets.

Supply and Demand

U.S. natural gas prices are largely driven by supply and demand figures. As in any free market, prices tend to rise when demand outweighs supply, and prices tend to fall when supply is greater than demand. With that said, there are several factors contributing to natural gas supply and demand in the marketplace. We will study each factor in detail below as it relates to both the supply of and the demand for natural gas. Please remember: due to their close correlation, when natural gas prices rise, electricity prices rise, and vice versa.

Natural Gas Supply Factors

First, we will study the various factors that directly impact supply. Natural gas supply numbers can be categorized into three major sections: production, storage levels, and balance of imports/exports. Let’s take a closer look at each category below.

Gas Production:

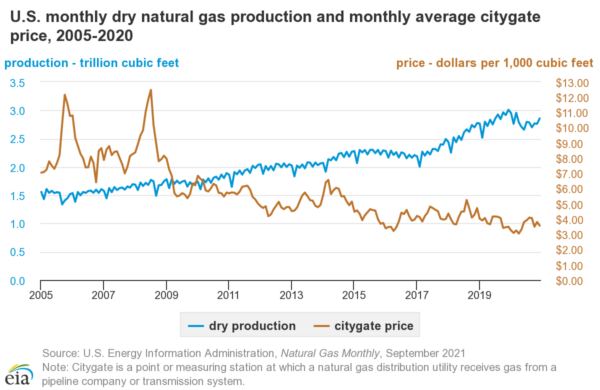

The production of natural gas is a prominent factor in determining total supply figures. Natural gas production surged in the U.S. over the last decade with exploration efforts in the Marcellus Shale area. Typically gas production is a process by which energy companies and speculators purchase or lease land where gas has been identified in the ground. Drilling operations are then constructed to extract the gas from under the soil or out of porous rock sediment below the earth’s crust. The chart below from the EIA displays the correlation between gas prices and production numbers. As you can see, price decreases as production increases.

Gas Storage:

Another key factor in determining natural gas supply figures is natural gas storage. When natural gas is drilled for and produced, oftentimes it is not consumed immediately. In fact, since most of natural gas demand comes from heating in the winter months, natural gas needs to be stored for usage at a later date. Energy producers rely on storage facilities to house natural gas until it is ready to be consumed. In fact, April 1 to October 31 is known as “injection season” when natural gas is injected into underground storage facilities. Each week, a natural gas storage report is published (see chart below) outlining the total amount of natural gas supply in reserve. Storage numbers have a direct correlation to natural gas supply.

Imports and Exports:

Lastly, the volume of natural gas imports and natural gas exports is a key indicator in determining supply levels. As the U.S. continues to be the world leader in natural gas production, many producers liquefy gas for export to Europe and Asia. Calculating exports against production is paramount in understanding total natural gas supply figures.

Natural Gas Demand Factors

Next, we will study the various factors that directly impact demand for natural gas. These factors can be categorized in three major areas: weather, economic growth, and the price and availability of alternative fuels.

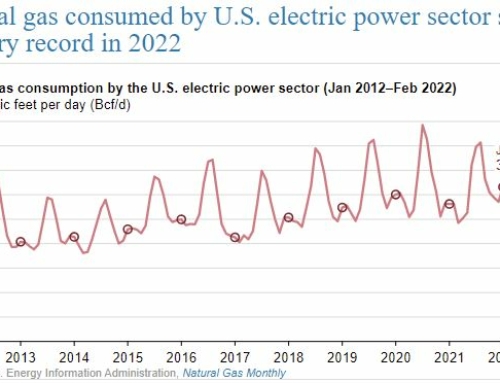

Weather:

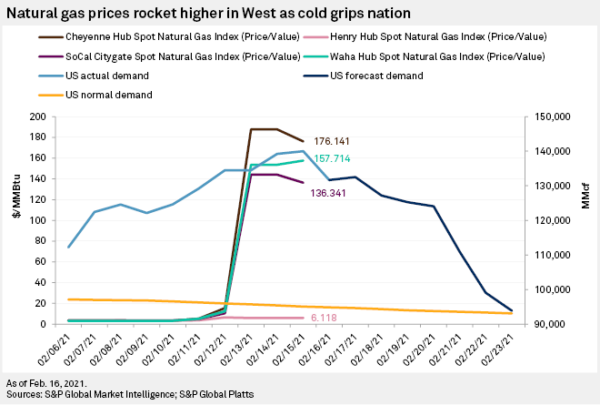

Weather has the strongest impact on natural gas demand. During the winter months, when there are prolonged cold spells throughout a region or the entire country, it drives consumer demand for heating, a critical use for natural gas. In fact, in the shorter term outlook, it is often said that weather is the primary driving force behind big price swings in natural gas. In February 2021, Texas experienced Winter Storm Uri that brought unprecedented cold weather to the state. The chart below outlines how this weather had a direct impact on Texas natural gas prices.

Economic Growth:

Economic growth is another key factor affecting natural gas demand. As the economy booms and GDP grows there are more businesses and buildings relying on natural gas for their operations. Certain processes such as baking, cement production, and plastics manufacturing rely heavily on natural gas. As the economy grows, more and more businesses begin to use natural gas hence increasing the demand for the commodity.

Availability and Price of Alternative Fuels:

Lastly, the availability and price of alternative fuels can also play a factor in overall natural gas demand. Since certain facilities, such as manufacturing plants and power generation stations, can switch between fuel sources such as natural gas, coal, and petroleum, when the price of those alternative fuels becomes less expensive they can stop using natural gas. When the price of alternative fuels falls, so does the demand for natural gas. Alternatively, when the price of alternative fuels increases, the demand for natural gas may also increase.

Independent Electricity Factors

As we stated before, electricity and natural gas prices are closely tied. So when the price of natural gas rises, so does the price of electricity and vice versa. One outlier to keep in mind is the local cost of electricity congestion. Electricity congestion is the localized demand for electricity in a regional market. Although electricity demand can be correlated to natural gas demand on a national level, sometimes regional events such as a line outage can drive congestion on local power lines. When there is much demand or congestion on a regional power system, the cost of power tends to rise at the specific location. So, even though gas prices are declining, local congestion can drive up power prices in certain markets.

Great write-up, I am regular visitor of one’s blog, maintain up the excellent operate, and It is going to be a regular visitor for a long time.