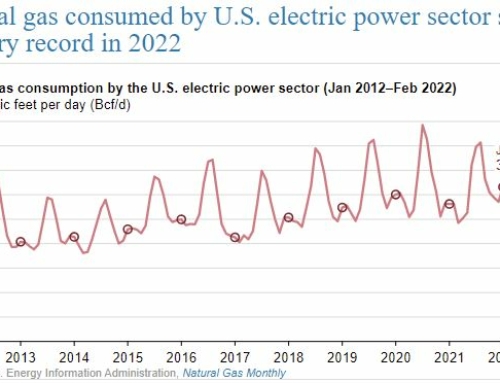

The Russia-Ukraine conflict is driving crude oil prices to near $100/bbl. Will the crisis impact U.S. natural gas and power prices? Historically, high crude prices encourage more crude output, and with it comes associated natural gas, providing downward pressure on the fuel. Today however, many drillers are publicly stating that that they will not increase production and will pour the profits into stock buybacks and dividends, even at $150/bbl to $200/bbl. Disruptions to European gas supply may add bullish sentiment with greater interest in U.S. LNG exports. Associated gas accounted for about 15 percent of overall U.S. gas production in 2020. The Permian region of western Texas and Eastern New Mexico produces about 50% of U.S. associated gas.

Article from our partners at ENGIE Resources

Pretty! This has been an incredibly wonderful post. Many thanks for supplying this info.

Thanks for enjoying this post Erlene!

I feel that is one of the most vital information for me. And i am glad studying your article. However wanna statement on few basic things, The website taste is great, the articles is in reality nice : D. Excellent activity, cheers

Hey There. I found your blog using msn. This is an extremely well written article. I will be sure to bookmark it and return to read more of your useful information. Thanks for the post. I will definitely comeback.